SumthinWhittee

Hopefully Santa gives these out this year. Best gift to help counter the elementary school propaganda. #tuttletwins

We can probably agree that politicians don’t have a firm grasp on the relationship between their actions and negative consequences.

Every now and then, we are given a special reminder of this truth. This week we got one directly from the White House briefing room.

For background: as I write this newsletter, a behemoth “reconciliation” bill called the “Build Back Better Act” is making its way through congress. Its 2,465 pages include measures to address climate change, enact massive entitlement expansions like universal childcare and “free” college, and require businesses to provide mandatory paid family leave for employees.

Of course, these big-government programs don’t materialize out of thin air. They aren’t funded by good intentions or campaign speeches. Eventually, someone has to foot the bill.

That’s why this bill contains provisions to raise the corporate tax rate from 21% to 26% and top capital gains taxes from 20% to 25%. And while “tax the rich” might make for a catchy slogan, it’s never really that simple.

Biden has repeatedly promised that he will not raise taxes on anyone making less than $400K per year. But we know all about unseen consequences, and economic studies have shown time and time again that corporate taxes always affect the rest of the country through lower wages and higher prices on goods and services. So while the tax rate for many of us may not go up on paper, our chances of prosperity are still plummeting.

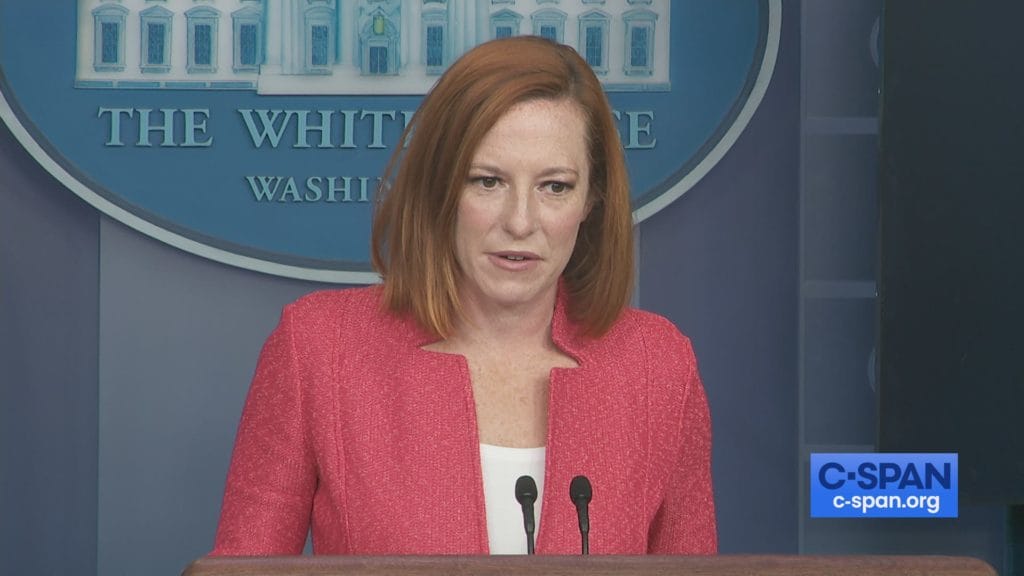

On Tuesday, one reporter raised this concern, asking Secretary Psaki if Biden would break his promises by signing this bill, citing a study from the Joint Committee on Taxation that signaled tax increases would be passed onto middle- and working-class families.

Here’s what Psaki had to say.

“I have not looked at the document or the report that you have put out….Obviously, the President’s commitment remains not raising taxes for anyone making less than $400,000 a year. There are some — and I’m not sure if this is the case in this report — who argue that, in the past, companies have passed on these costs to consumers. I’m not sure if that’s the argument being made in this report. We feel that that’s unfair and absurd, and the American people would not stand for that.”

Focus for a moment on the last sentence of that word salad.

This administration believes that companies passing along the government’s legalized plunder costs is unfair and absurd. Not cause and effect. Not the consequences of their disastrous, backward policy. Unfair. And. Absurd.

I know that, personally, paying even more for everyday products isn’t going to help my family thrive. (Never mind inflation driving costs through the roof as it is…)

You see, this is not a matter of fairness or absurdity. It’s reality. And reality, try as we might, cannot be manipulated by attempts to re-engineer the economy in favor of government programs and controls.

French economist F. A. Hayek warned of the disasters caused by laws like the “Build Back Better Plan” in his book, The Road to Serfdom. He paints an eerie picture of what happens when we sacrifice our economic liberties for promises of comfort from the government.

While this book is highly worthy of your time and attention, it’s not the easiest thing for a kid to understand. And if we want a chance of turning this country around before it’s too late, we need to talk to our kids about unintended consequences, starting today.

That’s why I wrote The Tuttle Twins and the Road to Surfdom, a kid-friendly and story-driven version of Hayek’s crucial warnings. In this book, Emily and Ethan see the horrible consequences of seemingly “nice” policies in a town called Surfdom… And why the musings of politicians aren’t always what they seem.

and story-driven version of Hayek’s crucial warnings. In this book, Emily and Ethan see the horrible consequences of seemingly “nice” policies in a town called Surfdom… And why the musings of politicians aren’t always what they seem.

Our country can ignore reality all we want, but we’ll never be able to outrun consequences. So join me, and let’s raise a generation of independent thinkers who ask the right questions.

Until next time…

—Connor

There are many subtle ways that socialist ideas are being introduced, taught, and reinforced directly to your children.

Our e-book walks through several examples to help raise your attention to this agenda so you can help your children avoid being indoctrinated to support the state.

Hopefully Santa gives these out this year. Best gift to help counter the elementary school propaganda. #tuttletwins

When ur bedtime story teaches ur girl about the federal reserve & what a crock of crap it is. Vocab words: Medium of exchange & fiat currency. #tuttletwins for the win

“My just-turned-5 year old told me he is planning to read all the #TuttleTwins books today. It’s 10AM on Saturday and he’s already on his third. #Homeschooling ftw.”