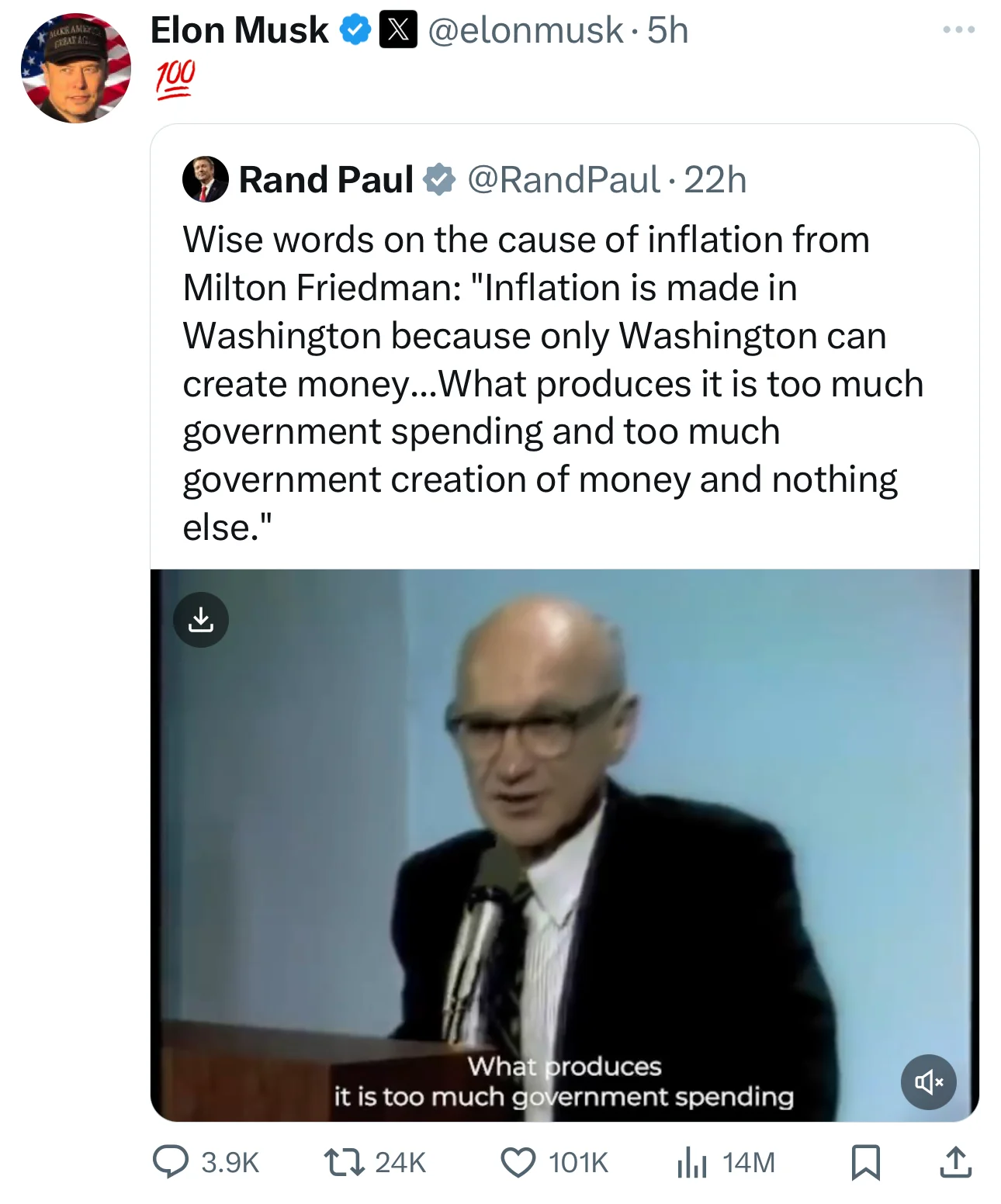

Have you ever noticed how, whenever prices start rising, politicians point the finger at “corporate greed”?

They want us to believe that, overnight, companies suddenly decide they can charge you more for groceries, gas, or pretty much everything you buy.

Give me a break.

Inflation isn’t caused by businesses trying to pad their profits—it’s caused by the government printing money and spending far beyond its means.

When the money supply increases without a corresponding increase in goods and services, the value of each dollar drops, and you end up paying more for the same stuff.

It’s just basic economics, but politicians don’t want to talk about it because it puts the blame squarely on their shoulders.

Think back to 2020 and 2021. As the pandemic unfolded, Congress passed several stimulus packages, pushing trillions of dollars into the economy. In a very short period of time, the Federal Reserve’s balance sheet ballooned by nearly $4 trillion.

This wasn’t money the government had saved up for a rainy day—it was literally created out of thin air.

Fast forward to today, and we’re dealing with inflation rates not seen in decades.

The prices of everything, from used cars to eggs, surged, and families felt the pinch in their wallets.

And it certainly isn’t a uniquely American experience. Remember Venezuela?

Their government flooded the economy with newly printed money, leading to hyperinflation where prices doubled every few days, and the local currency became worthless.

It’s a drastic example, but the principle is the same: when governments print money without restraint, inflation is the inevitable result.

We can observe this same phenomenon in another areas as well.

One of the best examples is college degrees.

Once upon a time, having a degree meant you stood out in the job market. It signaled that you had the dedication and specialized knowledge to contribute in a meaningful way. But as the government made it easier for everyone to attend college through federally backed student loans, degrees became more and more common.

When everyone has one, they become less valuable—just like money that’s printed without any backing.

The degree saturation got to a point where you needed a degree to even get a foot in the door for jobs that don’t require anything close to college-level knowledge.

Want to be an entry-level salesperson? Better have that diploma!

Applying to answer phones or manage social media accounts? A bachelor’s degree is “preferred.”

It’s not that these jobs are bad—far from it—but most of them can be learned through on-the-job training, or skills developed through real-life experience. They can certainly be done without four years and thousands of dollars in tuition!

Companies are wising up and many, like Google, Amazon, and Koch, have dropped degree requirements entirely for many roles. CEOs are saying they’ve seen what colleges are churning out, and they’ve realized that a diploma no longer signals someone who is hard working or competent.

So instead of looking for degrees, they’re looking for candidates with real skills.

This is something I’ve been saying would happen for years. Heck, I even wrote a book about it called Skip College, because I believe young people get further ahead by learning tangible, real-world skills than by spending four years (and accruing a mountain of debt) sitting in classrooms.

Just like inflation devalues the dollar, the abundance of degrees has devalued higher education.

When everyone has a degree, a degree just doesn’t have the same “purchasing power.” Not to mention that in order to get everyone a degree, the standards have to be “adjusted” to accommodate passing grades for students who didn’t get in to college on merit alone.

But that’s a topic for a whole other email.

Just like the Federal Reserve continues to print money, the government continues to subsidize student loans, and incentivize colleges to make inclusivity more important than ability. They’re keeping the cycle going and trapping more and more young people in debt without any kind of a guarantee on a return of investment.

It’s the same old story: when government gets too involved—whether it’s printing money or making college accessible to the point of saturation—we’re the ones who lose.

Politicians like to blame “corporate greed” for inflation, or argue that everyone needs a degree to succeed, but it simply isn’t true. Thankfully, more and more people are starting to realize it.

And that’s a really good thing.

Because it means parents are starting to look seriously at alternatives when it comes to educating their kids in a way that sets them up for real success.

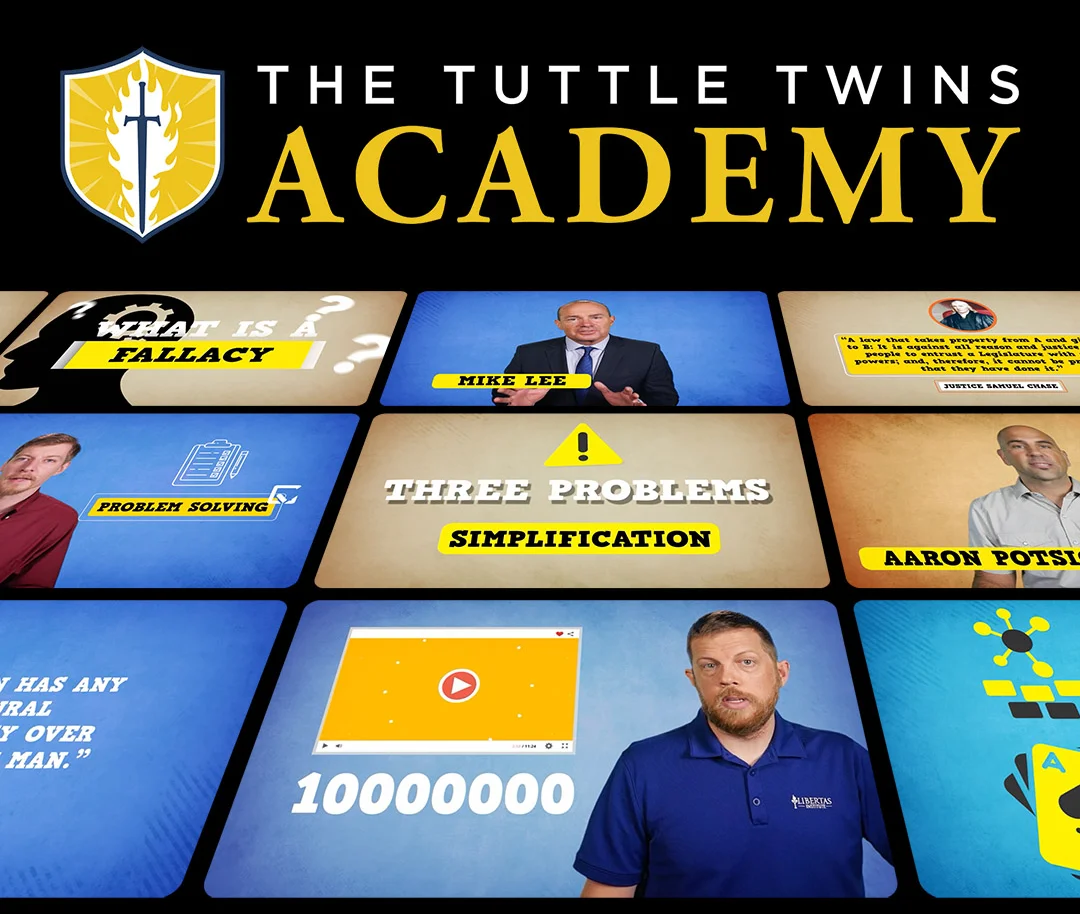

That’s why we created The Tuttle Twins Academy.

Our goal is to empower teens with a real understanding of how the world actually works, and to give them the skills they need to make a future they can be excited about. The Academy takes complex subjects—yes, we cover inflation—and breaks them down into easy-to-understand lessons that will actually prepare your kids for the world they’ll be facing.

Plus it’s fun and interesting. Your kids won’t just be checking a box, slugging through boring lessons where they have to memorize names and dates to get a “good grade.”

They’ll realize that learning is fun, and more importantly, that learning isn’t something that takes place in a classroom, during set hours, but that it’s something they should be doing for the rest of their lives—always striving to ask questions, dig deeper, and gain new understandings of the ideas they encounter.

In a world where inflation is eating away at savings, and college degrees aren’t worth what they used to be, it’s going to be harder than ever for the rising generation to get ahead. That is, unless they are given opportunities to learn the things that other kids aren’t learning, and to set themselves apart as different—better—than the mainstream.

Understanding money, inflation, how the economy works, and the real value of things isn’t just for economists or politicians. It’s for every family who wants to thrive despite the challenging times we are living through.

Check out the Academy today and give your kids a leg up in a world that desperately needs people who can think for themselves, and who have the skills and knowledge to be tomorrow’s innovators and business leaders.

I guarantee that if your kids can get a head start on those skills, they’ll be way ahead of the game.

— Connor