SumthinWhittee

Hopefully Santa gives these out this year. Best gift to help counter the elementary school propaganda. #tuttletwins

Saving money during a recession can be a daunting task for families, especially with the added expenses that come with raising children. However, it is important to be mindful of your finances and look for ways to cut back on spending during these tough economic times. Here are a few tips to help parents save money during a recession.

Creating a budget is the first step in saving money during a recession. It’s important to track your income and expenses to see where your money is going and identify areas where you can cut back on spending. This will help you make a plan for redirecting that money towards savings. Additionally, consider setting aside a certain amount each month for unexpected expenses, like car repairs or medical bills, so you won’t have to dip into your savings when these expenses arise.

Housing expenses can take up a large portion of your budget, but there are ways to reduce these costs. Consider downsizing your home or renting out a room to a tenant to offset the cost of your mortgage or rent. You can also take steps to reduce your utility bills, such as investing in energy-efficient appliances and turning off lights and electronics when not in use. Don’t forget to check for any leaks or other areas where you could be losing energy, and fix them as soon as possible.

Eating out can be a costly habit, but it’s possible to save money on food during a recession. Try cooking at home or meal prepping, and take advantage of sales and deals at the grocery store to save on food costs. Packing your own lunch for work or school is another great way to save money, and you can experiment with new, budget-friendly cuisines that you may not have tried before. Consider using online resources to find deals and coupons for restaurants you love, so you can still treat yourself occasionally without breaking the bank.

Quality doesn’t have to come at a high price. Look for deals and sales at local stores, and take advantage of coupons and promo codes. Online shopping can also be a great way to find discounts, but make sure to compare prices from different retailers to ensure you’re getting the best deal. Don’t be afraid to try discount retailers, as they often carry similar products at a lower cost. When shopping for big-ticket items, consider waiting for special sales or holidays when prices may be lower.

Owning a car can be expensive, especially during a recession. Consider using public transportation, carpooling, or biking to save on transportation costs. If alternative transportation isn’t an option, make sure to keep up with routine maintenance, as neglecting your car can lead to expensive repairs down the road.

Refinance loans: Refinancing your loans can help you save money on interest and reduce your monthly payments. If you have any outstanding loans, consider shopping around for a lower interest rate to save on interest over the life of the loan. Keep in mind that refinancing may come with fees, so be sure to factor these into your decision. Don’t hesitate to consult a financial advisor to determine if refinancing is the best option for your situation.

Being mindful of your spending during a recession is crucial. Avoid making impulse buys and take time to consider whether you really need something before making a purchase. You can also try a “30-day rule,” where you wait 30 days before making a big purchase to see if you still want it. This can help you avoid buying items you may not use or may quickly lose interest in. When making a purchase, consider purchasing items that have multiple uses or that can be used for a longer period of time, as this can help you save money in the long run.

Saving money during a recession is all about being mindful of your spending and finding ways to cut back on costs. By creating a budget, reducing your housing costs, eating in more, shopping for deals, using public transportation, refinancing loans, and avoiding unnecessary purchases, you can protect your finances and prepare for a better financial future.

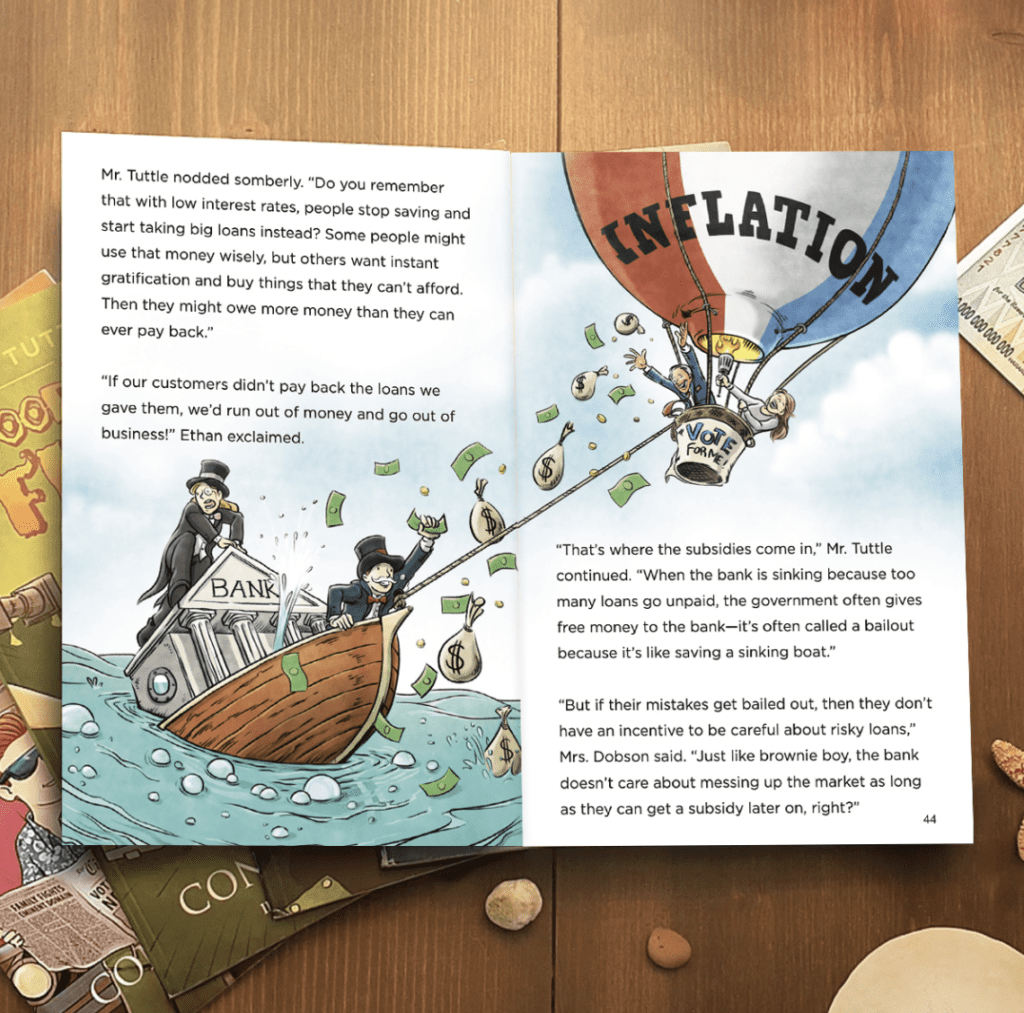

But, as a parent, it’s also important to educate the next generation about money and the economy. The Tuttle Twins books are a great way to help teach children about these topics in a fun and engaging way. By purchasing these books, you can help ensure that the kids in your life grow up to be financially savvy and economically literate, which will benefit them in the long run.

So, take action today and invest in the financial education of your loved ones!

There are many subtle ways that socialist ideas are being introduced, taught, and reinforced directly to your children.

Our e-book walks through several examples to help raise your attention to this agenda so you can help your children avoid being indoctrinated to support the state.

Hopefully Santa gives these out this year. Best gift to help counter the elementary school propaganda. #tuttletwins

When ur bedtime story teaches ur girl about the federal reserve & what a crock of crap it is. Vocab words: Medium of exchange & fiat currency. #tuttletwins for the win

“My just-turned-5 year old told me he is planning to read all the #TuttleTwins books today. It’s 10AM on Saturday and he’s already on his third. #Homeschooling ftw.”